[ad_1]

As an online trader or investor, you must file tax returns for your investments, regardless of whether you have made a profit or loss. Now, you may be wondering how to file returns for your portfolio.

Reporting profit and loss from multiple trading and investment-related transactions can seem to be daunting. But not if you are a trader on Angel One. We have partnered with Quicko and ClearTax to make sure filing tax returns does not intimidate you ever again! Both Quicko and ClearTax are online tax planning and filing platforms that help simplify the entire income tax e-filing process for you.

But before getting into it, as an investor/trader, it is important to understand how trade and investment-related income is taxed.

How to Report Loss from F&O Trades?

Under section 43(5), F&O loss in the income tax return (ITR) is to be considered non-speculative business income under PGBP (Profits and Gains from Business and Profession). Therefore, the traders need to file their F&O income tax details under form ITR3, which is designated for PGBP income. In other words, any losses or profits must be reported via this form. It is the norm for individuals, companies or other legal entities.

How to Compute Income From F&O?

In case of calculating turnover from F&O for tax filing purposes,

Turnover for F&O Trading = Absolute Profit

Therefore, absolute turnover here refers to the sum of positive and negative differences.

Note: The calculation of options trading turnover has been updated as per the eighth edition of the guidance note dated 14/08/2022 (applicable from Assessment Year 2022-23). Earlier, turnover in options trading included “Absolute Profit + Premium on Sale of Options.”

Example:

Suppose Mr. A buys –

10 futures at ₹100 per future and sells them at ₹110.

20 options at ₹50 per option and sells them at ₹40.

Therefore, absolute turnover for Mr A would be –

₹ [(110-100)*10]+[(50-40)*20] = ₹300

As you can see, a negative outcome like in the second trade is ignored, and its value is taken to be positive, despite the loss.

Deposit Advance Tax on Gains

If you have gained more than ₹10,000 from F&O trading in a financial year, you are liable to pay tax on the income in advance. At least 15% of the total tax due should be deposited by June 15th, at least 45% by September 15th, at least 75% by December 15th, and the entire balance by March 15th.

What About Other Equity Trades on Angel One?

In addition to F&O trading, there are other types of stock trading, such as intraday trading, as well as short-term investment. Needless to say, you must also file ITR for share trading incomes. The rules on ITR for stock traders may be different from the F&O taxation rules:

Intra-day trading: Its income should be computed as business income but separate from F&O trading.

Short-term investment: A large volume and high frequency of short-term trades in equity shares may be treated either as business income or capital gains. Choose the basis with due diligence and reiterate it consistently across financial years.

Long-term investment: Gains from long-term equity investments may be treated as capital gains.

Let us now go over the details of the tax planning and filing process for your Angel One trades and investments. We will look at the various documents needed and how to plan and file your ITR efficiently using platforms such as Quicko and ClearTax.

ITR Forms Applicable for Traders

The following are the relevant documents related to ITR for F&O traders on Angel One, choose the one applicable to you:

1. ITR2 – Choose this form if you are treating your income as capital gains wherein the details of income are categorised under Schedule CG. The losses incurred are categorised under Schedule CYLA and Schedule BFLA.

2. ITR3 – This form can be used for futures and options (F&O) trading. More details will be given in the following sections.

3. ITR4 – This form is applicable if you follow a presumptive income scheme and declare profits at 6% of your turnover.

Documents Required to file ITR for traders

For ITR e-filing, keep the following documents handy:

- Form 16

- Form 26AS tax credit statement

- Aadhar card

- Bank statement when interest received is above Rs. 10,000

- Trading account statement from the broker

To make filing taxes related to your trading and Demat account easy, Angel One has partnered with Quicko and ClearTax. Read on to know more about it.

How to File Taxes with Quicko?

Follow these simple steps to import all the trades data from Angel One to Quicko for filing taxes:

1. Plan your taxes by importing all the data related to your trades:

a. Go to Planning > Tax P&L.

b. Click on Angel One.

c. On the next screen, enter your Angel One credentials to log in. Your tax details related to Angel One will be synced.

Note: Currently the integration with Angel One is supported in the Filing section only, due to some intermittent issue. Alternatively, you can import trades using Quicko Templates.

Note: Once you import your trading data, your Business & Profession Income will automatically be calculated based on the nature of your trades. You will be able to import Equity, Equity Derivatives, Currency & Commodity Derivatives trades. However, data on Mutual Fund trades will not get imported.

2. File your tax returns via Quicko:

a. Go to Filing > INCOMES > CAPITAL GAIN from the side navigation.

b. Click on Import from Broker.

c. Select Angel One > CONTINUE.

d. On the next screen, enter your Angel One credentials to log in.

e. Wait a few seconds to let your Angel One account’s Tax P&L sync with Quicko.

How to File Taxes with ClearTax?

E-filing income taxes via ClearTax is easy. Follow these simple steps for swift ClearTax ITR filing:

1. Visit the ClearTax website and log in to your ClearTax account.

2. Go to ‘Income Sources’ and then scroll to ‘Capital Gains Income’. Click on ‘Add Details’.

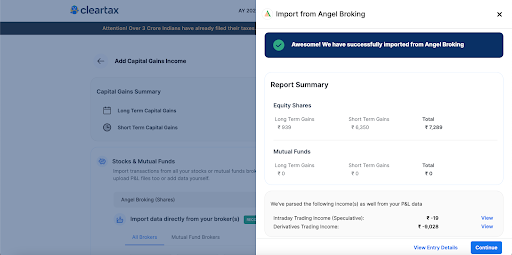

3. You will reach a page titled ‘Import data directly from your broker(s). Click on Angel One, and a window will open titled ‘Import from Angel Broking’.

4. Click on ‘Login & Import’. Thereafter, enter your Angel One credentials to log in to your Angel One account.

5. Your trading data will automatically be imported from Angel One to ClearTax. Data related to equity, mutual funds, intraday trading, derivatives trading, etc. will be shown category-wise.

6.Your ClearTax ITR for trades and investments on Angel One is recorded. Click on ‘Continue’ to move on to other taxes, if remaining.

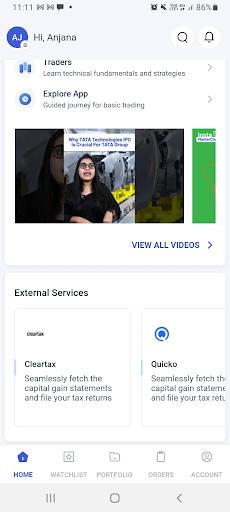

You can also file your taxes using Quicko and ClearTax from the Angel One app without switching to other sites. To do this, log in to Angel One. On the homepage, scroll down to ‘External Services’, where you will find tax filing options via Quicko and ClearTax.

Additional Points To Remember When Filing Taxes Relating to Trading

- Consequences of Treating Income as Business Income

When income or profits obtained from trading and investing is treated as business income, the following consequences take place:

– Expenditure incurred under administration would be categorised as deductible.

– Securities transaction tax (STT) will also come under the deductible category.

– Losses incurred while trading in futures and options (F&O) can be utilised to balance against gains from other sources such as property or any other source, except the taxpayer’s salary.

– On the other hand, losses that have not been absorbed can be carried forward for up to 8 years but can solely be set off against non-speculative income.

– In cases where the income from F&O is above ₹1 crore, a tax audit takes place.

Example:

Suppose you have made losses in F&O trades worth ₹1 lakh. But you have made gains worth ₹2 lakh in other non-speculative incomes. Then your total taxable income for the year becomes ₹1 lakh i.e. 2 lakhs minus 1 lakh. That is how the F&O loss in ITR will offset incomes from other sources to reduce the overall income.

2. Consequences of Treating Income as a Capital Gain

When income or profits obtained from the trading of F&O is treated as capital gain, the following consequences take place:

– STT will not come under deductible, unlike expenditures, in Futures and Options.

– Any losses will be categorised as short-term capital loss, which can be utilised to balance capital gains earned via other means. Such a loss can be carried forward for up to 8 years.

3. Expenses That Traders Can Claim on Income from F&O

Taxpayers are permitted to claim deductions from F&O taxation on the following expenses incurred during business operations:

– Brokerage fees and commission, subscriptions to trading-related journals

– Consultant charges and salaries of individuals hired to assist you in your business

– Postage charges, travel and conveyance expenditures

– Telephone or fax expenses

– Internet expenses

– Depreciation on assets utilised for business operations

But it is important that you maintain the receipts or bills for such expenses. Also, any expense over ₹10,000 on a single day must not be paid in cash to be deemed valid.

4. When to Maintain the Book of Accounts?

If you are running a business as an individual or HUF, you can be required to maintain accounts related to F&O taxation if:

– your income is above ₹2.5 lakhs or

– your turnover is above ₹25 lakhs in any of the 3 preceding years, or in the first year in case of a new business.

These rules apply to individual F&O traders as well. But your accounts will be simpler. Just keep your trading statements, expense receipts and bank account statements.

In case you are following a presumptive income scheme and declaring profits at 8% of your turnover under Section 44AD, then you are not required to maintain books of account. However, if you declare profits at less than 8%, then you must maintain books of account.

5. When to Get the Audit Done?

– Tax audit requirements are covered under Section 44AB of the Income Tax Act, 1961.

Under Section 44AB(a), auditing account is required for F&O traders with business income above ₹10 crores.

– An individual or entity with a turnover up to ₹2 crore can declare their taxable income at 6% of their total turnover. This scheme is called the presumptive taxation scheme.

– As per, Section 44AB(e), tax audit will also be applicable if all the following conditions are met together –

a. The loss or profit from F&O is lower than 6% of the trading turnover (8% in the case of non-digital transactions).

b. You have opted out of the presumptive taxation scheme in any of the preceding 5 previous years.

c. Your total income exceeds the basic exemption limit.

– Also, tax audit is necessary if Section 44AD(4) is applicable and the taxable income is greater than the basic exemption limit.

If you follow a presumptive income scheme and declare profits at 6% of your turnover, then you have to file ITR4. However, you will be required to file ITR3 if you declare your F&O income as a presumptive business with capital gains.

Final Words

Filing taxes is an important part of being a responsible citizen of India. Quicko and ClearTax are here to make this experience a seamless and pleasant one!

For more such updates on Angel One, follow the Angel One blog or join the Angel One community page! Open Demat account with Angel One if you wish to invest in stocks, commodities, currencies, etc.

FAQs

How to report ITR for F&O using Quicko?

You can use Quicko to plan your tax returns related to F&O by filling up the details as per the available Quicko template. Thereafter, you can file your returns via Quicko by syncing your Angel One tax P&L with Quicko.

[ad_2]

Source link